INDIA IS ALL SET TO EMERGE AS THE MOST PREFERRED COUNTRY IN THE PRESENT GEOPOLITICAL AND GEO-ECONOMIC CONTEXT

PRANAV KOSHAL, Founder, Bulls I Consulting

The impact of COVID-19 on infrastructure forebodes high level of unpredictability and uncertainty with disruption of supply chains and business ecosystems; the possibility of behavioral change; and the specifics of government response resulting in a W-shaped economic recovery, which translates into economic activity due to phases of lockdown and followed by easing and renewal of economic activity until a vaccine is developed and scaled-up.

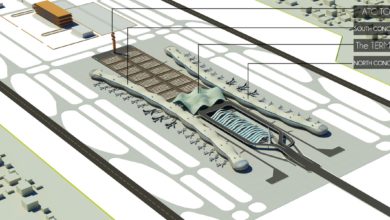

Pre-COVID Infrastructure sector in India had been experiencing rapid growth with the development of urbanization and increasing involvement of foreign investments in this field. The last few years had also witnessed a phenomenal, leading to world-class facilities coming up across various parts in the country – from roadways, railways to airports and other smart-city initiatives have been initiated throughout the country in the form of new highways, roads, ports, railways and airports, power plants, urban and rural infrastructure, including water supply, sewerage, and drainage, irrigation and agriculture systems.

After agriculture, the construction, infrastructure and real estate segments are the second-largest employment providers. The infrastructure and construction sectors are responsible for propelling India’s overall development and Government’s focus on initiating policies that would ensure time-bound creation of world-class infrastructure in the country. To achieve the GDP of USD 5 trillion by 2024-25, India needs to spend about USD 1.4 trillion on infrastructure. India needs adequate and timely investment in quality infrastructure, the report of the Task Force on National Infrastructure Pipeline has projected total infrastructure investment of Rs 102 lakh crore during the period FY2020 to 2025 in India. In 2018, India ranked 44th out of 167 countries in the World Bank’s Logistics Performance Index 2018. Foreign Direct Investment received in the Construction Development sector from April 2000 to June 2019 stood at US$ 25.12 billion, according to the Department of Industrial Policy and Promotion.

We emerged from COVID-19 outbreak with effective mobilization of savings into productive usage of capital — the mantra for the Indian economy going forward. The current global environment also offers India an opportunity for a fresh start post COVID. Increasing flow of goods has now spurred increase in rail, road and port traffic, necessitating further infrastructure improvements. This increased impetus to develop infrastructure will attract both domestic and international players. Private sector is emerging as a key player across various infrastructure segments, ranging from roads and communications to power and airports. The Government of India has introduced a single window clearance facility to accord speedy approval of construction projects. In the road’s sector, many private players are entering the business through the public-private partnership (PPP) model. India is expected to become the third largest construction market globally by 2022. India plans to spend US$ 1.4 trillion on infrastructure during 2019-23 to have a sustainable development of the country.

Reasons to invest in India post pandemic: India has been one of the top choices for investments especially after PM Narendra Modi took charge of the government and started his comprehensive global outreach. India is all set to emerge as the most preferred country in the present geo-political and geo-economic context as the country has with

- Few restrictions on foreign direct investment (FDI) for infrastructure projects

- Tax holidays for developers of most types of infrastructure projects, some of which are of limited duration

- Opening up of the infrastructure sector through PPPs

Several infrastructural companies are likely to shift their bases from China post COVID. India, the world’s fifth largest economy with an abundant labor force, offers the best alternative in terms of depth and size of the markets. Therefore, India has its stage set to attract both market-seeking and resource-seeking FDI upon a gradual recovery in India, an opportunity to invest in Indian infrastructure.

Permit savings and investment to finance building assets in order to bridge the infrastructure financing gap. There is a need for clarity in policy and expedite conflict resolution — the hallmarks of the new Indian infrastructure age. Secondly, as the RBI expands liquidity — prudence in lending, keeping in mind the current NPAs, is needed. Balancing the need to provide savers with avenues to deploy their savings and allowing corporates to utilize the capital for productive use is important. This projects a W-shaped recovery could be India’s trajectory, assuming continuing regional/containment zone lockdowns. A continued rise in COVID-19 cases in the summer and a winter relapse at the end of the third quarter of FY 2020-21 (that is, around December 2020) could drive this scenario. With the current limited scope of stimulus measures, growth could resume in the third quarter of FY 2020-21 but then slow down or contract over the next five quarters with a few intermittent rebounds and a final recovery in FY 2021-22 as the vaccine becomes available.

The “collateral damage” of the forecasted GDP slowdown, that is, the second-order impact, will be felt most acutely in employment, poverty alleviation, per capita income and overall nominal GDP. Unemployment may rise to 35% from 7.6%, resulting in 136 million jobs lost and a total of 174 million unemployed. Poverty alleviation will receive a set-back, significantly changing the fortunes of many, sending 120 million people into poverty and 40 million into abject poverty. Per capita income may drop by more than 10%, reducing overall consumer demand and savings. COVID-19 could create an opportunity loss of up to USD 1.0 trillion of nominal GDP. Even though, the government has announced a fiscal stimulus of USD 22.6 billion, while the Reserve Bank of India slashed the repo rate by 75 basis points and announced liquidity support of over USD 49.8 billion on an aggregate basis.

The government should devise revival packages for the labor-intensive infrastructure sectors. I suggest the creation of a USD 1 trillion infrastructure build-out fund to create a modern India across several sectors such as smart cities, urban water supply and distribution, mining, oil and gas, logistics, cold chain and modern freight transport. Multilateral low-cost funding can be accessed from countries such as Japan, the US, the UK and the EU, and the government should consider seeding up to 5% (USD 50 billion) of the mega investment fund to kick-start these efforts. The government can consider new measures to increase private participation in infrastructure projects by sharing risk equitably, proposing new Special Purpose Vehicle structures and simplifying dispute resolution and contract enforcement mechanisms.

About Author:

Pranav Koshal, founder of Bulls-i Consulting,has more than two decades of experience in the field of Urban & Infrastructure, Oil & Gas and Mining sector.