India emerges as strategic anchor in shifting trade landscape; Leads APAC office leasing with 47% share in 2024: Knight Frank

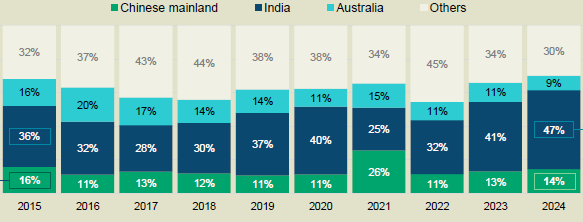

Knight Frank, in its newly released Asia-Pacific Horizon II report titled Whiplash to Resilience: Corporate Real Estate in the New World Order, highlights India’s growing dominance in the regional office leasing market. In 2024, India accounted for 47% of all APAC office leasing volumes, up from 36% in 2015, underlining its strategic relevance amid trade shifts, supply chain diversification, and macroeconomic headwinds.

India’s office transaction volumes reached a record 6.68 mn sq m (7.19 mn sq ft) in 2024, led by robust demand from Global Capability Centres (GCCs), multinational occupiers, and third-party IT service providers. The report positions India as a long-term, stable hub for occupiers seeking cost efficiencies, talent depth, and infrastructure readiness, particularly in cities such as Bengaluru, Hyderabad, Pune, and NCR.

Office leasing volumes pivoting toward India

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said, “India’s share of Asia-Pacific’s office leasing volumes rising to 47% is a testament to the country’s robust fundamentals and growing appeal as a strategic hub for global corporations. With the rapid evolution of India’s services and manufacturing ecosystems, the country is increasingly seen as a stable and scalable alternative for long-term investments. As global corporates seek operational resilience amid ongoing trade realignments, India’s real estate sector stands well-positioned to play a pivotal role in the regional growth narrative.”

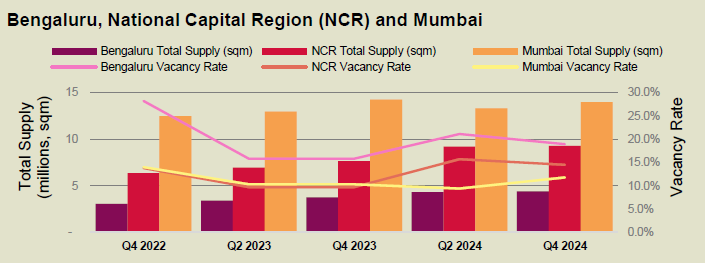

While several APAC markets face oversupply challenges (Shanghai, Beijing), Indian industrial hubs such as Mumbai, NCR, and Bengaluru have maintained balanced vacancy levels, backed by sustained leasing activity.

The report notes that build-to-suit formats and flex leases are gaining traction in India, reflecting a shift toward customisation and operational agility.

India sits in the ‘low exposure, moderate resilience’ quadrant. This indicates relatively low external trade dependence and a strong ability to absorb global shocks. In contrast to export-heavy economies like South Korea or Singapore, India’s large domestic consumption base, prudent fiscal management, and diversified services sector buffer it against external volatility—making it a reliable anchor in the region.