As affordable financing remains a key driver of demand in real estate, we welcome the RBI’s decision to cut the repo rate by 50 bps, thereby encouraging end-users to make purchase decisions. However, it is important is that the benefits are passed on to borrowers immediately. While homebuyers will be able to secure home loans at lower rates, developers will benefit from low borrowing costs, thereby easing financing pressures. Overall, a rate cut would strengthen market confidence, infuse much-needed liquidity, and also act as a strong signal of policy support for the real estate sector and the broader economy, thereby encouraging investments. With sustained demand and softening home loan interest rates, the sector’s growth momentum will definitely accelerate further with continued policy support, firmly establishing the real estate sector as a key driver of the nation’s economic development.

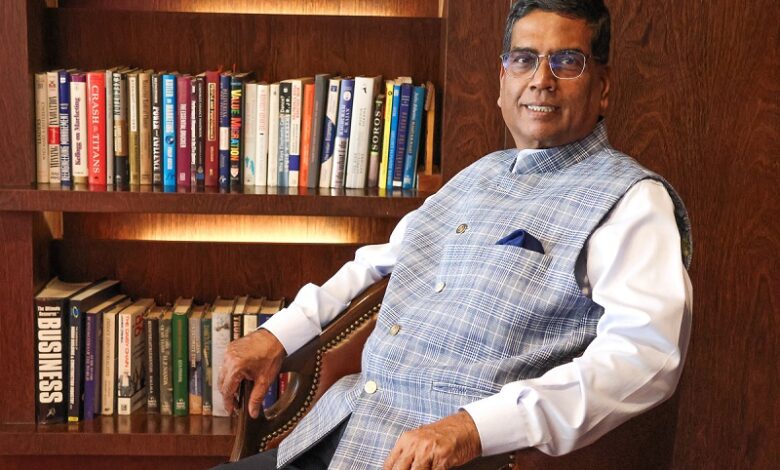

Lincoln Bennet Rodrigues, Chairman & Founder, Bennet & Bernard.

A rate cut, while widely anticipated in some quarters, comes as a welcome move for the real estate sector. Lower borrowing costs will positively influence affordability and purchasing decisions, particularly in the budget and mid-income segments. While luxury homebuyers are typically not driven by EMIs or interest rates, a softening monetary policy signals broader economic confidence. This sentiment plays a key role in high-ticket real estate investments, especially in markets like Goa, where lifestyle migration and legacy asset creation are driving demand. We expect renewed interest from NRIs, long-term investors, and domestic HNIs who are looking to diversify into tangible, inflation-resilient assets. Overall, a rate cut acts as a confidence marker, even if its direct impact on the luxury segment is limited.