The new- age millennials

The pause in policy rates and accommodative stance reflects the central bank’s concern about inflation and surplus liquidity in the banking sector. One-time restructuring for Covid-19 stressed accounts is a step in the right direction. Also, an amount of Rs 10,000 crore of additional liquidity provided to NABARD and NHB will help the NBFCs and housing sector to tide over the liquidity crisis.

While the RBI has pumped huge amount into the financial system to encourage banks to lend more, yet loan growth has been languishing because of the economy’s slump. The interest rate should be reduced with firm liquidity measures as this is the need of the hour backed by specific fiscal measures to give much-required stimulus to the sector. However, further cut in policy rates would have definitely resulted in the much needed demand booster ahead of the festive season.

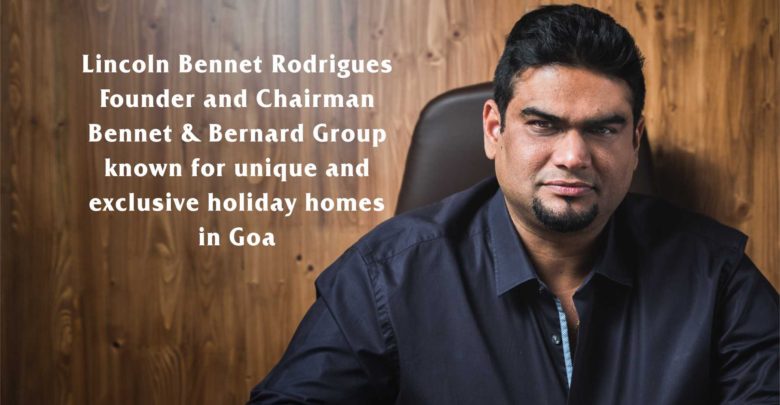

The current scenario offers excellent investment opportunities in residential real estate as affordability is at all time high. The new- age millennials will want to shift to dream holiday home that offers safety, privacy and luxury, all in one space. The post-pandemic world will be good for the real estate sector as it offers you the best bet – stability, security and safety. Real estate sector is one of the few sectors which have the potential to kick start a sluggish economy. Going forward, we hope that the government takes more developer and investor-friendly initiatives for the betterment of the real estate market in the near future.