Infrastructure – The driver of Indian Economy

By – Mr. Devendra Kumar Vyas, CEO, Srei Equipment Finance Limited

India has emerged as the fastest growing major economy in the world. With the current government’s focus on infrastructure of the country, there has been an increased allocation of funds towards the sector. As per the Union budget for FY 2018–19, the total estimated capital expenditure towards infrastructure sector stood at INR 5.97 trillion compared to INR 4.94 trillion in FY 2017-18. Sectors such as railways, and roads and highways, and housing and urban affairs have witnessed increased year-on-year (“y-o-y”) budget allocations for FY 2018-‘19 by 22%, 10%, and 57% respectively.

Recently, the Indian government has approved a total investment of Rs. 6,920 billion for the construction of 83,677 kms of roads in five years. These create requirement of capital goods on a large scale and increase in the number of contractors executing these projects.

The government has been continuously pushing forward for the infrastructural development in the country. MoRTH is actively trying to resolve all issues with stakeholders to bring back the Public Private Partnership (“PPP”) model on track.

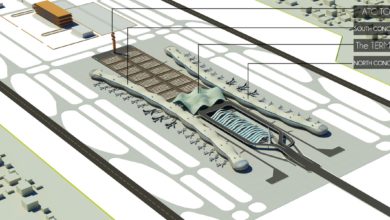

Hybrid Annuity Model (“HAM”) has been quite helpful in lifting the sentiments of the developers and contractors. The entry of new contractors in the sector also affirms that road sector is on the highway to progress. Likewise, many initiatives have been taken to fast track Railways with redevelopments and modernization of stations, dedicated freight corridors, focus on safety, high-speed rails, etc., all of which will bring huge opportunities for the construction, mining, and allied equipment (“CME”) industry. The Irrigation sector is being revived with renewed vigour, as seen in the states of Telangana and Maharashtra. Capacity additions in ports, and green-field airport projects in Mopa and in Navi Mumbai, have brought hope to these sectors.

In the last 48 months of coming into power, the government has taken important steps to streamline the economy. New policy measures were announced to make the business environment more conducive and transparent. Goods and Services

Tax (“GST”), the biggest reform, is no doubt, a game changer in our taxation system as it will bring the much-needed ease of doing business, and catalyze growth of the infrastructure sector. Further, introduction of GST has led a major boost to the leasing industry, signaling a movement towards a more mature financing market. Recent reduction of GST rate for construction equipment from 28 to 18% will also boost equipment sales in the future. Another important reform in the banking sector has been the introduction of Insolvency and Bankruptcy Code (“IBC”). The new framework has made resolution of stressed assets a time-bound process unlike earlier when it resulted in interminable delays in the courts.

The whole debtor-creditor relationship has undergone a massive change, resulting in improved credit culture of the country and thereby leading to improvement in ease of doing business. The government has also passed many laws and policies pertaining to arbitration, coal linkage, HAM, easing of FDI norms, off-take of stressed assets, and so on. It is natural that when new policies are introduced, there will be some hiccups, however; we have already started seeing positive impacts on the ground; especially because the intention is to create a conducive business environment.

As 2018-19 will be the last budget year for this government’s five-year term, the government should ideally accelerate the implementation of its big, ambitious schemes and projects that were announced in the last three years. These include Sagarmala, Jal Marg Vikas, AMRUT, Housing for All, the Diamond Quadrilateral for high-speed railways, river linkages, besides roads and highways. The upcoming business scenario across sectors looks buoyant for the coming year. The fact is that there remains a massive amount of construction work yet to be done in the country, which will call for large volumes of construction equipment. This in turn results in increased opportunities for equipment industry.

Overview of CME Market and CME Financing Market

According to Feedback Consulting, the CME industry has witnessed a good revival since FY’16 after a three year decline

(FY’13–FY’15). The overall Indian CME industry which grew by upwards of 20% in FY’18 compared to FY’17 (83,600 units) in terms of unit sales is expected to see heightened business activities and an estimated compounded annual growth rate (“CAGR”) growth of 14% between FY’17 and FY’20 in terms of volume in units, as the government is likely to invest heavily in infrastructure sector thereby lifting business prospects in construction equipment sector.

As the construction segment requires large capital expenditure, financing accounts for approximately 80–85% of the total equipment purchased, and in the case of overseas purchases, it accounts for approximately 90%. Most financing is procured through loans while leasing is the second most common mode of financing. Traditionally, India has been an outright equipment purchase market for project requirements. However, this could change. Large contractors who previously outsourced only earthwork and other non-essential activity have begun subcontracting more activities and modules. Consequently, leasing options with their associated tax benefit opportunities are becoming more attractive.

There are signs among finance companies that the market is becoming more receptive to alternate financing options.

According to Feedback Consulting, the construction equipment finance industry is expected to grow at a CAGR of 19% between 2017 and 2020. The overall construction equipment industry is expected to reach 125,000 units by 2020 and the market for new equipment finance market will continue to have a share between 87–90% for the next three years. With the current announced projects, demand will continue for the earthmoving equipment industry, which will have a share between 68-70% of the overall CME finance market. Banks and NBFCs are expected to have an equal share in the CME finance industry for the next one to two years with the equipment leasing industry expected to grow at a CAGR of 26% for the next three years.